PREVIOUSLY-OWNED CLEAN VEHICLE CREDIT (25E)

* EXPIRED *

Used EV tax incentive (25E)

The deadline to use this incentive to purchase a vehicle has passed. If you purchased an eligible used EV from a registered dealership by Sept. 30, 2025, read on for how to apply this credit when you file your taxes in 2026.

View other tax credits for EVs:

Jump to section

Introduction

Introduction

Disclaimer: The information presented here is for educational purposes only. It is not intended to provide specific tax guidance. For questions regarding your individual tax situation, we suggest consulting with your tax advisor.

Tax Credit

Up to $4,000

Expired September 30, 2025

Which used EVs qualify?

Used EVs must meet IRS requirements in order to qualify for the 25E tax incentive. Both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) qualify, but traditional hybrid vehicles (without a charging plug) do not.

To make sure that the EV you want to purchase qualifies for this tax incentive, check the requirements below:

Qualifying used EVs must meet the following requirements:

Have a sale price of $25,000 or less before additional fees

Be purchased from a registered dealer. Private car sales (direct from owner to buyer) are not eligible.

Have a model year two or more years earlier than the calendar year in which your vehicle purchase was made. For instance, to use the 25E tax incentive for a vehicle purchased in 2025, the model year must have been 2023 or older.

Weigh less than 14,000 pounds

Have a battery capacity of least 7 kilowatt hours

Be for use primarily in the United States

Not have been previously resold after August 16, 2022

Come from a qualified manufacturer

You can find a complete list of the information your car dealer must provide on the IRS website.

Who qualifies for the used EV tax incentive?

Incentives are limited based on income. Here’s what you need to know.

Individuals and households that meet income requirements

Used EV purchases are subject to income caps based on income tax filing status. Those caps are:

$150,000 for married filing jointly or a surviving spouse

$112,500 for heads of households

$75,000 for all other filers

If you fall at or below the income cap for your category, you're eligible for a 25E tax incentive!

What is the 25E used EV tax incentive?

The used EV tax incentive provides a discount of 30% up to $4,000 off the sale price of a used EV from a registered dealership.

The 25E Used EV Tax Incentive provides up to $4,000 toward used EVs — including cars, SUVs, and light duty trucks — with a sale price of $25,000 or less.

Eligibility depends on vehicle type and income. To determine eligibility and help you find a used vehicle that qualifies for the tax credit, we’ll list all the factors you need to know.

If you’re looking into buying a new EV, check out our breakdown of the 30D tax incentive instead.

Used EVs must meet multiple requirements in order to qualify for this incentive, so make sure you talk with your car dealer before you make a purchase. They’re required by law to provide you with the information you need to ensure your EV purchase qualifies.

You can find a complete list of the information your car dealer must provide on the IRS website.

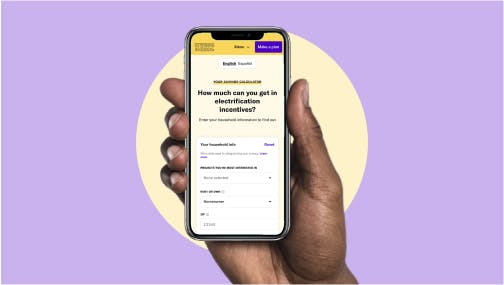

Discover other incentives with the incentives calculator!

There are other incentives that you may qualify for. Our incentive calculator will show you a personalized list of incentives.

Go to Incentive CalculatorHelpful tools

Personal Electrification Planner

Interested in upgrading your home to all-electric appliances and vehicles? Generate a personalized electrification plan based on your particular home, lifestyle, and priorities — all in just a few minutes.

Incentive Calculator

Find out how much you could save with tax credits and rebates for heat pumps, water heaters, electric vehicles, electric stoves, rooftop solar, wiring upgrades, and energy efficiency improvements to your home.

Drive electric

Better, faster, cleaner, cheaper? Learn about the costs, savings, and health benefits of electric vehicles—and say goodbye to gas for good.