FEDERAL ALTERNATIVE FUEL VEHICLE REFUELING PROPERTY CREDIT (30C)

EXPIRES SOON!

EV charger tax credit (30C)

Act fast! This credit expires on June 30, 2026.

The 30C EV Charger Tax Credit makes it more affordable to add an electric vehicle (EV) charger to your home. You can claim this incentive if you are eligible and install your new EV charger by June 30, 2026.

View other tax credits for EVs:

Jump to section

Introduction

Introduction

Disclaimer: The information presented here is for educational purposes only. It is not intended to provide specific tax guidance. For questions regarding your individual tax situation, we suggest consulting with your tax advisor.

Tax Credit

Up to $1,000

Use by June 30, 2026

Who qualifies for the 30C EV charger tax credit?

Americans who live in a rural or low-income area may qualify for this tax credit.

People living in certain non-urban or low-income communities

Eligibility for the 30C tax credit is determined by where you live. If you live in a population census tract (or area of your county) that is considered not urban or low-income by the Census Bureau, you are eligible.

Find out if your community qualifies by using the U.S. Department of Energy’s 30C Tax Credit Eligibility Locator.

Must pay federal income taxes

The 30C tax credit is non-refundable, which means that it can only be used to reduce the federal taxes you owe—you cannot receive the credit as a refund.

Pairing with new or used EV incentives

If you’re eligible and you’ve already claimed a rebate on the purchase of a new EV or used EV, you may still qualify for the 30C EV charger tax credit. If you’re looking to buy an EV, check out our explanations of the 25E tax incentive for used EVs and the 30D tax incentive for new EVs.

Which EV chargers qualify?

EV chargers must meet certain requirements set by the US Department of Energy.

If you live in a qualifying location, as long as you purchase new EV charging equipment and install it at your primary residence in the US or a US territory by June 30, 2026, your EV charger will qualify for the tax credit.

How to use the EV charger tax credit

Make sure you’re eligible, and that you purchase your EV charger by June 30, 2026. Be sure to keep your receipts, then submit IRS Form 8911 with your federal tax return.

Here are all the steps you need to take to save on your new EV charger.

Verify that where you live qualifies you for the 30C tax credit by checking online.

Purchase and install your EV charger at your primary residence by June 30, 2026.

Fill out and submit IRS Form 8911 using the above documentation and file it with your income tax return for the year in which your EV charger was purchased.

Also, you can only apply for and claim the 30C tax credit for the tax year in which your EV charger installation was made. For example: if you purchased your EV charger in late 2025 but had it installed in 2026, you have to file the tax credit with your 2026 tax return.

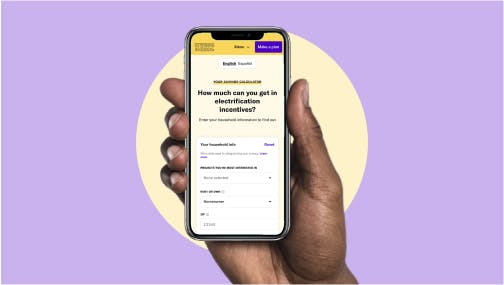

Discover other incentives with the incentives calculator!

There are other incentives that you may qualify for. Our incentive calculator will show you a personalized list of incentives.

Go to Incentive CalculatorHelpful tools

Personal Electrification Planner

Interested in upgrading your home to all-electric appliances and vehicles? Generate a personalized electrification plan based on your particular home, lifestyle, and priorities — all in just a few minutes.

Incentive Calculator

Find out how much you could save with tax credits and rebates for heat pumps, water heaters, electric vehicles, electric stoves, rooftop solar, wiring upgrades, and energy efficiency improvements to your home.

EV charger

Home EV chargers can charge your electric vehicle up to 2-3 times faster than plugging into a standard outlet—and prevent you from waiting in line at charging stations.