Federal tax credits ended, but savings remain!

At the stroke of midnight on December 31, 2025, we said farewell to most of our beloved federal tax credits for home electrification upgrades. Key word: federal. There are still state and local programs out there to help you save.

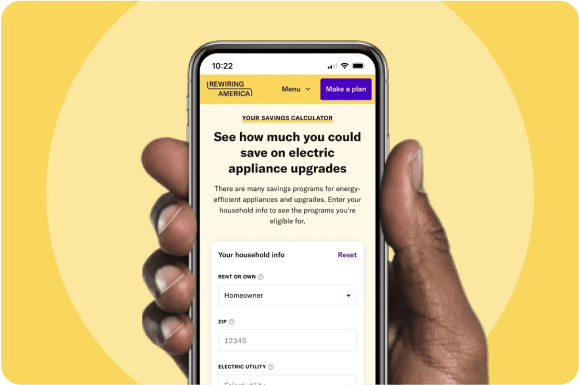

As the saying goes, when one door labeled federal incentives closes … well, you know the rest. Use our calculator to find out if you’re eligible for state, local, or utility incentives on home upgrades.

Plug into your electric next step

Whether you're searching for savings, or ready to book a contractor, we've got resources for you. And if you've already installed an electric appliance, we want to hear all the details!

Check for incentives

Many state, local, and utility incentives are still our there. Use our incentive calculator to see what incentives you might be qualified for.

Plan ahead for your project

Our Personal Electrification Planner can organize your projects and available incentives in one place. Choose a whole-home view or just start with a single project (heat pump-only view is now live!).

Tell us how things went

If you completed an installation last year, we’d love to hear about your experience. Your feedback helps us understand what worked, what didn’t, and how to better guide future electrifiers.

Already used those credits? Congrats! Here’s what you need to know for tax time:

Cross those “t’s” and dot those “i’s” before you file your taxes in 2026.

Disclaimer: The information presented here is for educational purposes only. It is not intended to provide specific tax guidance. For questions regarding your individual tax situation, we suggest consulting with your tax advisor.

Tax credits (in order of expiration)

* EXPIRED * New EV (30D) | Up to $7,500 | The deadline has passed. More info |

* EXPIRED * Used EV (25E) | Up to $4,000 | The deadline has passed. More info |

* EXPIRED * Heat pump air conditioner / heater (25C) | Up to $2,000 | The deadline has passed. More Info |

* EXPIRED * Heat pump water heater (25C) | Up to $2,000 | The deadline has passed. More Info |

* EXPIRED * Weatherization / insulation (25C) | Up to $1,200 | The deadline has passed. More Info |

* EXPIRED * Electrical panel (25C) | Up to $600 | The deadline has passed. More Info |

* EXPIRED * Home energy audit (25C) | Up to $150 | The deadline has passed. More Info |

* EXPIRED * Rooftop solar installation (25D) | 30% of qualifying costs | The deadline has passed. More Info |

* EXPIRED * Battery storage installation (25D) | 30% of qualifying costs | The deadline has passed. More Info |

* EXPIRED * Geothermal heating installation (25D) | 30% of qualifying costs | The deadline has passed. More Info |

EV Charger (30C) | Up to $1,000 | Chargers placed in service by June 30, 2026 are eligible. More Info |

Have questions about the tax credits? Check our FAQs page for answers.

*The above deadlines refer to federal tax credits only. Many state, local, and utility incentives are still out there. Our team is working hard to incorporate all these incentives into our savings calculator and other tools. We’re up to 29 states (over 55% of the U.S. population covered) with plans to keep expanding.

Communities doing the work

There are thousands of state and local organizations committed to getting more electric appliances in more homes. Rewiring America is actively partnering with some of these organizations to bring down equipment costs and improve installation experiences. Plug into our email list for the latest updates on our work. If you’d like to get more involved, we’d love to hear from you.

Coast to coast, households are making the switch to electric appliances and the post-installation view looks pretty great.

“Upgrading our home with a heat pump has been a game-changer and a great investment for our family. From the moment we switched, we've noticed a difference in both comfort and savings. We’re thrilled to see more families like ours benefit from these incentives.”

Troy, California

“When we first bought our house, the energy bills were jarring. We knew we couldn’t afford to keep filling the oil tank. Thanks to the 25C Tax Credit, we were able to install a far more efficient and affordable heat pump system last winter.”

Annie, Alaska

“In our first summer, the first three months, our electric bill was only like $15 because we have solar panels, and it was a very sunny summer.”

Cathy, Ohio